2024/2025 Annual Savings Statement

Need help?

What's in your statement?

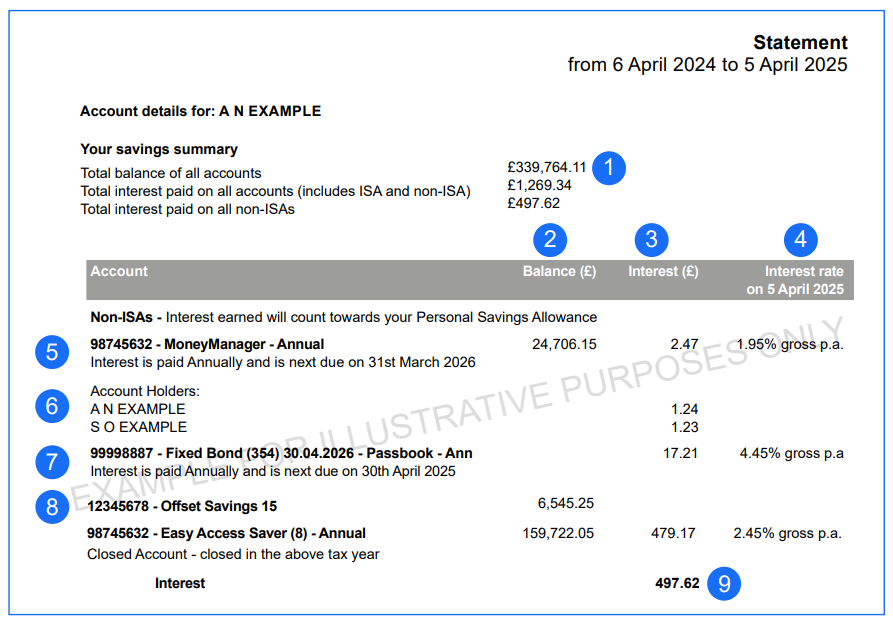

1. Summary

The balance on your account(s) and interest you have been paid from 6 April 2024 to 5 April 2025.

2. Balance

How much money is in the account on 5 April 2025, including interest that’s been added to the account.

3. Interest

The total amount of interest paid for each account in the 2024/2025 tax year.

If it’s a joint account we’ll tell you the total and also how much it would be for each account holder if it was shared equally.

If there is an odd number of pence, the extra penny goes to the account holder that has been a member the longest.

4. Interest Rate

The rate of interest for each account on 5 April 2025.

5. Account

Account name(s), number and for some accounts, your interest payment date.

6. Account Holders

The people named on the account. If someone was taken off the account before the date that interest was paid, or hadn’t been added before then, their name won’t show.

7. Closed Account

Any accounts closed between 6 April 2024 and 5 April 2025.

8. Offset

Your savings in this type of account are linked to your mortgage, to reduce the interest you pay. This is called the ‘Offset benefit’ and you’ll see it listed on your mortgage statements too.

9. Total interest (Excluding ISAs)

The total amount of interest paid on your non-ISA account(s) between 6 April 2024 and 5 April 2025.

You need to pay tax on any interest you earn above your Personal Savings Allowance; that’s £1,000 for basic rate taxpayers and £500 for higher-rate taxpayers. For tax returns you’ll need to let HMRC know how much interest you earned, so keep this statement safe.

For more information contact HMRC or visit the HMRC website.

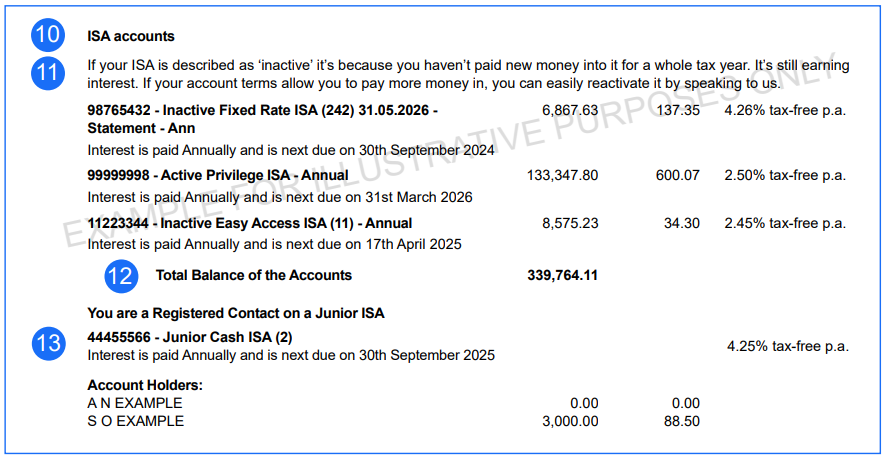

10. ISAs

Your tax-free Individual Savings Account(s). ISAs are in a separate section because the interest they earn doesn’t count towards your Personal Savings Allowance as they are always tax free.

Some of our ISAs are flexible. A flexible ISA means that you can take money out of your ISA and put it back within the same tax year without it counting further towards your annual ISA allowance, as long as you pay it back in before the end of the same tax year. The Specific Terms for your account will tell you if your ISA is flexible.

11. Inactive ISA

If your ISA is ‘inactive’ it means you haven’t put any new money in it for a whole tax year. Any money in there is still earning interest. If your terms allow you to put more money in, you can reactivate it by getting in touch with us.

12. Total balance of the accounts

This is the total amount of money in all the accounts (including ISAs) you hold with us on 5 April 2025.

13. Junior Cash ISAs

If you’ve opened any Junior Cash ISAs they appear here. You may not have any other accounts with us so your own balance will show as zero. The money in any Junior Cash ISAs you’re a registered contact for doesn’t count towards your personal balance as it belongs to the child.

Savings help

Compare savings accounts

Want help?

Our help section is bursting with useful information. If you'd rather chat, just give us a call.

Call us on 0800 121 8899

- Mon-Fri 8am-7pm

- Saturday 9am-2pm

- Sunday & Bank holidays Closed

Yesterday, people waited on average

17 seconds for savings enquiries

17 seconds for mortgage enquiries

Want help?

Our help section is bursting with useful information. If you'd rather chat, just give us a call.

Call us on

0800 121 8899

Saturday

Sunday

9am - 2pm

Closed

Closed

Yesterday, people waited on average

2 seconds for savings enquiries

27 seconds for mortgage enquiries