Understanding your mortgage statement

Your 2025 mortgage statement will be with you by 31 January 2026

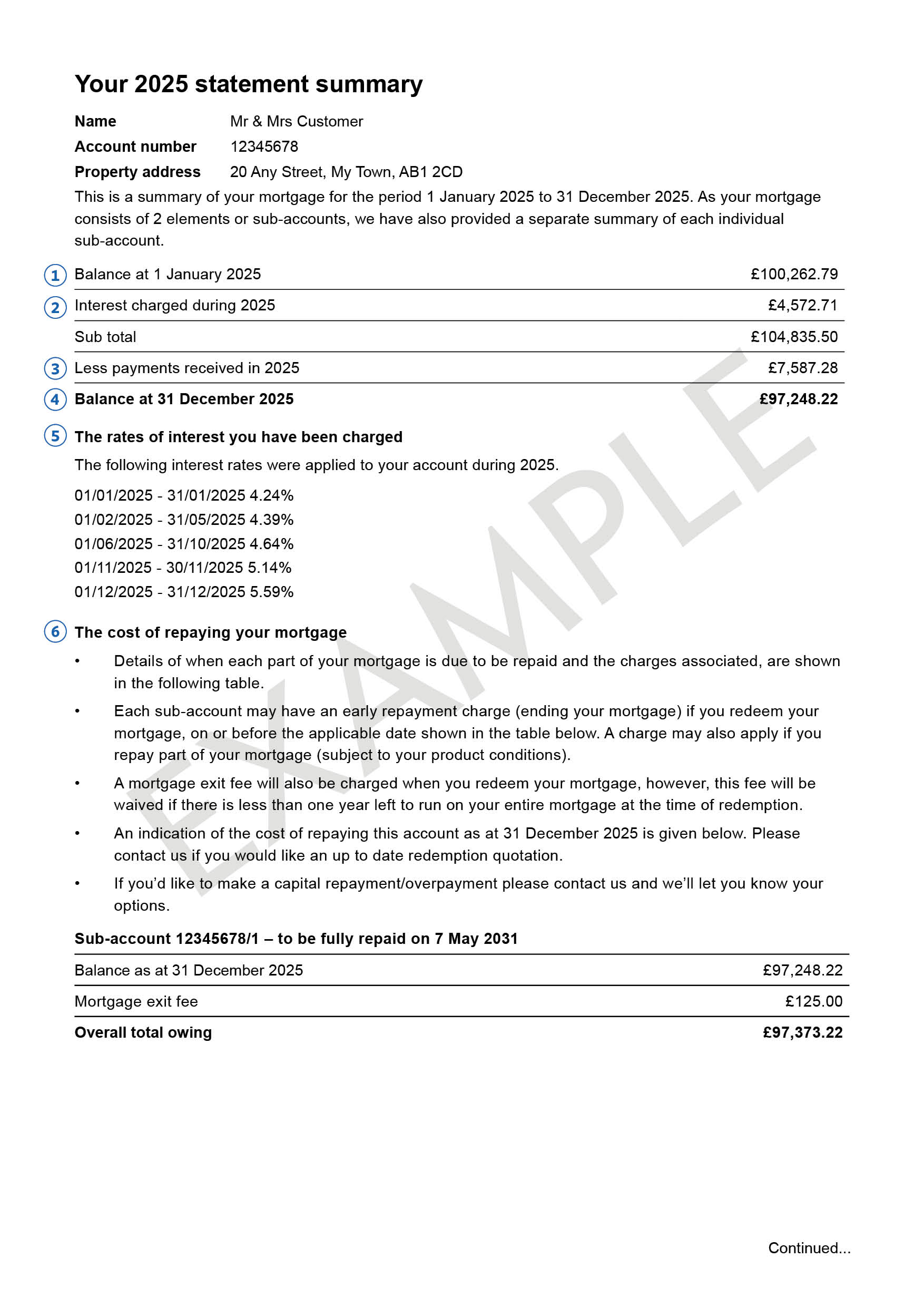

1. Balance at 1 January 2025

The money you owed as at 1 January 2025.

2. Interest charged during 1 January 2025 to 31 December 2025

This figure shows you how much interest was charged on your mortgage account(s) during 1 January 2025 to 31 December 2025.

3. Payments received during 1 January 2025 to 31 December 2025

The total payments credited to your account in 2025.

4. Balance at 31 December 2025

We calculate this using the following sum:

Start balance - Your outstanding mortgage balance at 1 January 2025 (or the original advances if this is a new mortgage), including any sub-accounts.

+ Interest - Interest charged, any additional advances and fees or charges for the year.

- Payments made - All mortgage payments you made in during 1 January 2025 to 31 December 2025.

= End balance - Your mortgage balance as at 31 December 2025.

5. Interest rates

The interest rate(s) charged on your mortgage during 1 January 2025 to 31 December 2025 together with the dates on which they changed, if this applies.

6. The cost of repaying your mortgage early

This is how much it will cost if you decided to repay your mortgage in full early, and the balance was correct on 31 December 2025. This will include a mortgage exit fee, unless your mortgage has less than one year to run on your entire mortgage balance at the time of redemption. Also, an early repayment charge may apply.

If your mortgage consists of sub-accounts we will show the cost of repaying each part on the individual sub-account summary pages.

If an early repayment charge does apply, we’ll provide its expiry date on the summary statement.

Your itemised statement explained

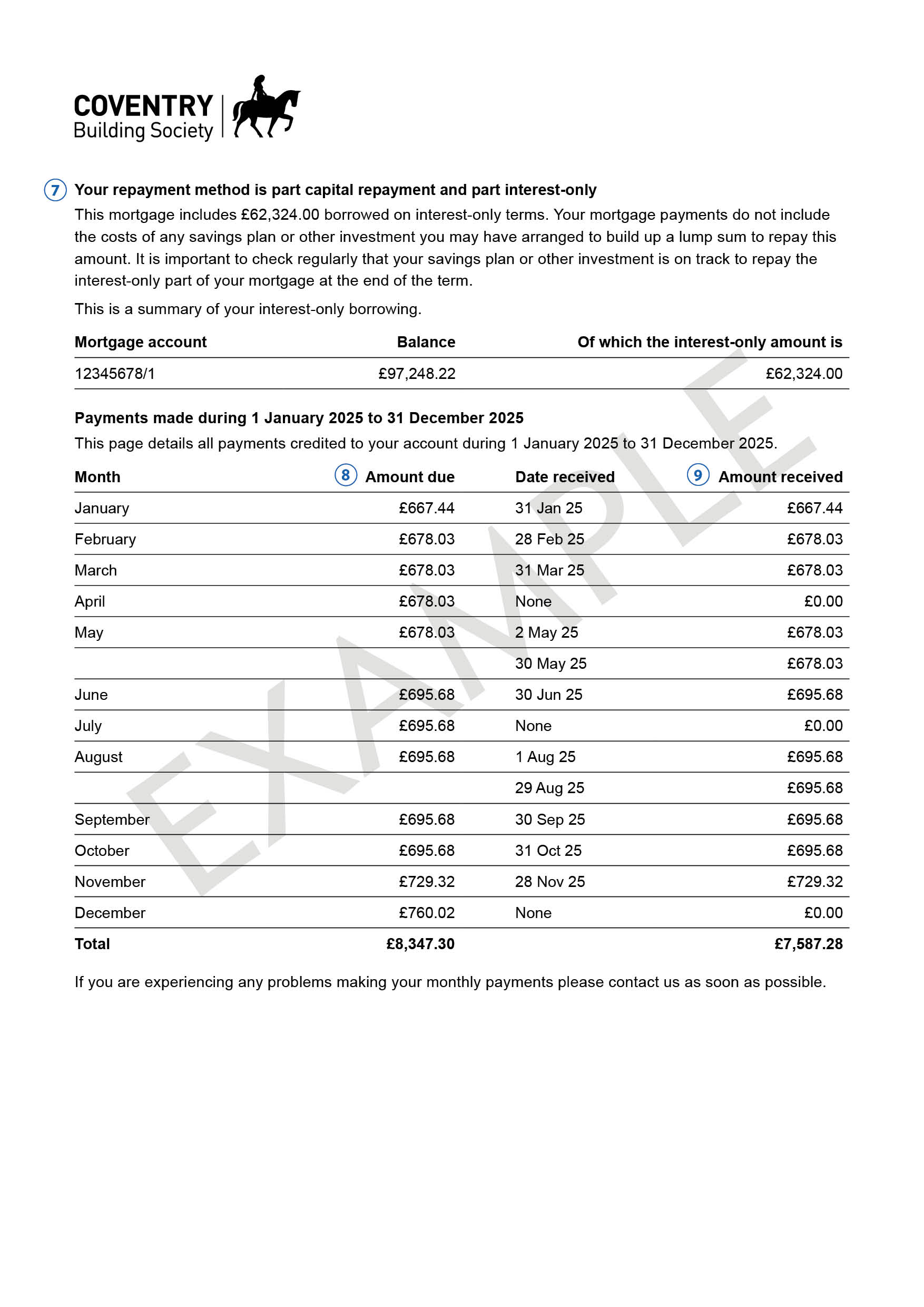

7. Repayment type

A reminder of the repayment scheme you’ve arranged with us, which will be one of three types:

- Capital repayment mortgage

Each month you repay some of the original amount borrowed, plus the monthly interest on the outstanding balance. - Interest-only mortgage

Your regular monthly mortgage payments only cover the interest charged on the money you’ve borrowed. - Part interest-only and part capital repayment mortgage

Your mortgage is a mix of these two types of scheme. For example, you may be repaying the money you borrowed plus interest on half your mortgage, while paying just the interest on the other half.

8. Amount due in 1 January 2025 to 31 December 2025

A list of the payments that were due on your mortgage during 1 January 2025 to 31 December 2025. If you find the amount due in one month varies significantly to other months, this could be due to an interest rate change on your mortgage, borrowing further funds or changes you have made to your mortgage e.g. from interest-only to capital repayment.

9. Amount received in 1 January 2025 to 31 December 2025

A breakdown of payments you’ve made to this mortgage during the past 12 months. A negative value may indicate a refund or an unpaid amount.

If the amount shows as £0.00:

If you have recently completed your mortgage, or have agreed a payment holiday with us during the year the amount due and amount received will show as £0.00 as no money is expected into your mortgage account. At the end of your payment holiday the payments and interest that haven’t been paid during the holiday period will remain outstanding.

An important note if you have an interest-only mortgage

With your interest-only mortgage your regular monthly mortgage payments only cover the interest charged on the amount you borrowed. So, unless you’re making overpayments, you’ll still have the total amount you borrowed left to repay when your mortgage comes to an end. By having an effective repayment plan in place now, you can be more confident that your finances are on course to repay your mortgage balance.

You should regularly check the performance of any plans you have in place to pay us back, such as savings plans or endowment policies.

If you have any queries, our dedicated Interest-only Services Team are only a phone call away and are ready to help on 0800 121 6353, Monday to Friday 8am-7pm and Saturday 9am-2pm. Please be aware that we can’t provide investment advice.

Want help?

Our help section is bursting with useful information. If you'd rather chat, just give us a call.

Call us on 0800 121 8899

- Mon-Fri 8am-7pm

- Saturday 9am-2pm

- Sunday & Bank holidays Closed

Yesterday, people waited on average

17 seconds for savings enquiries

17 seconds for mortgage enquiries

Want help?

Our help section is bursting with useful information. If you'd rather chat, just give us a call.

Call us on

0800 121 8899

Saturday

Sunday

9am - 2pm

Closed

Closed

Yesterday, people waited on average

4 seconds for savings enquiries

48 seconds for mortgage enquiries